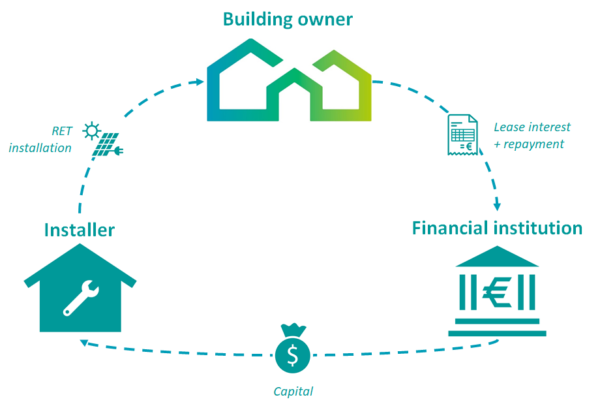

These kinds of capital equipment loans carry an interest rate anywhere between 6 and 12 with the rate largely dependent on the credit worthiness of the customer.

Capital equipment leasing interest rates.

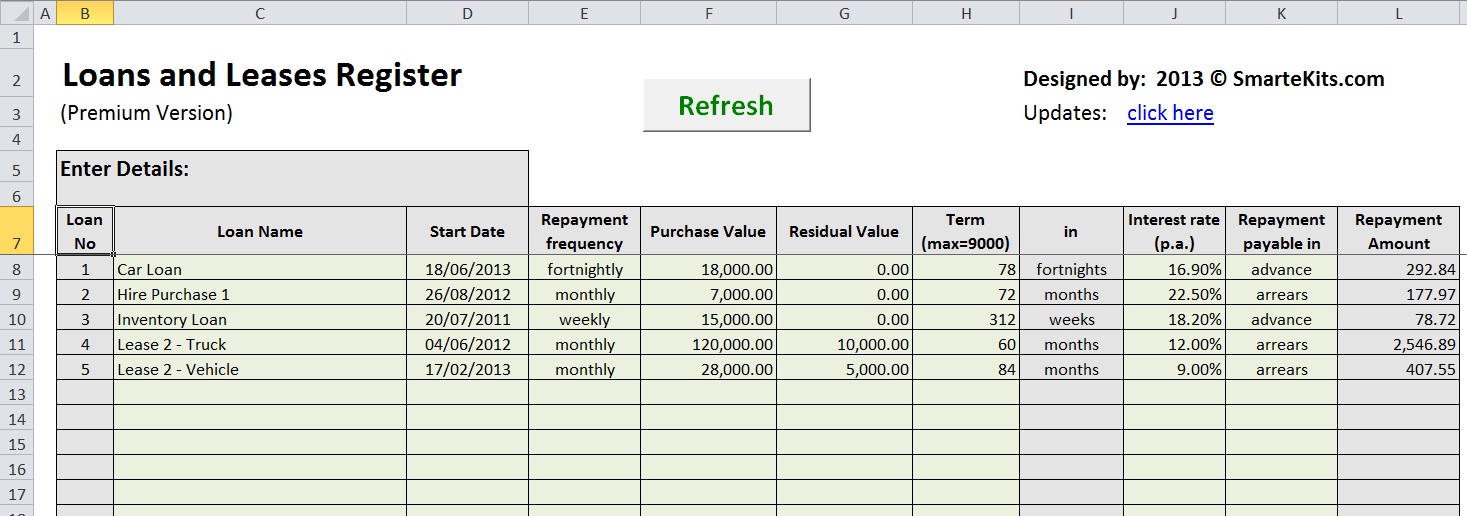

With leasing instead of dealing with interest rates or huge up front payments you pay a flat monthly rate with current capital equipment lease rates.

Let s say you have a busy medical practice and need a new mri machine.

Special pro and put residuals on new and late model used 2015 or newer combines for a limited time only.

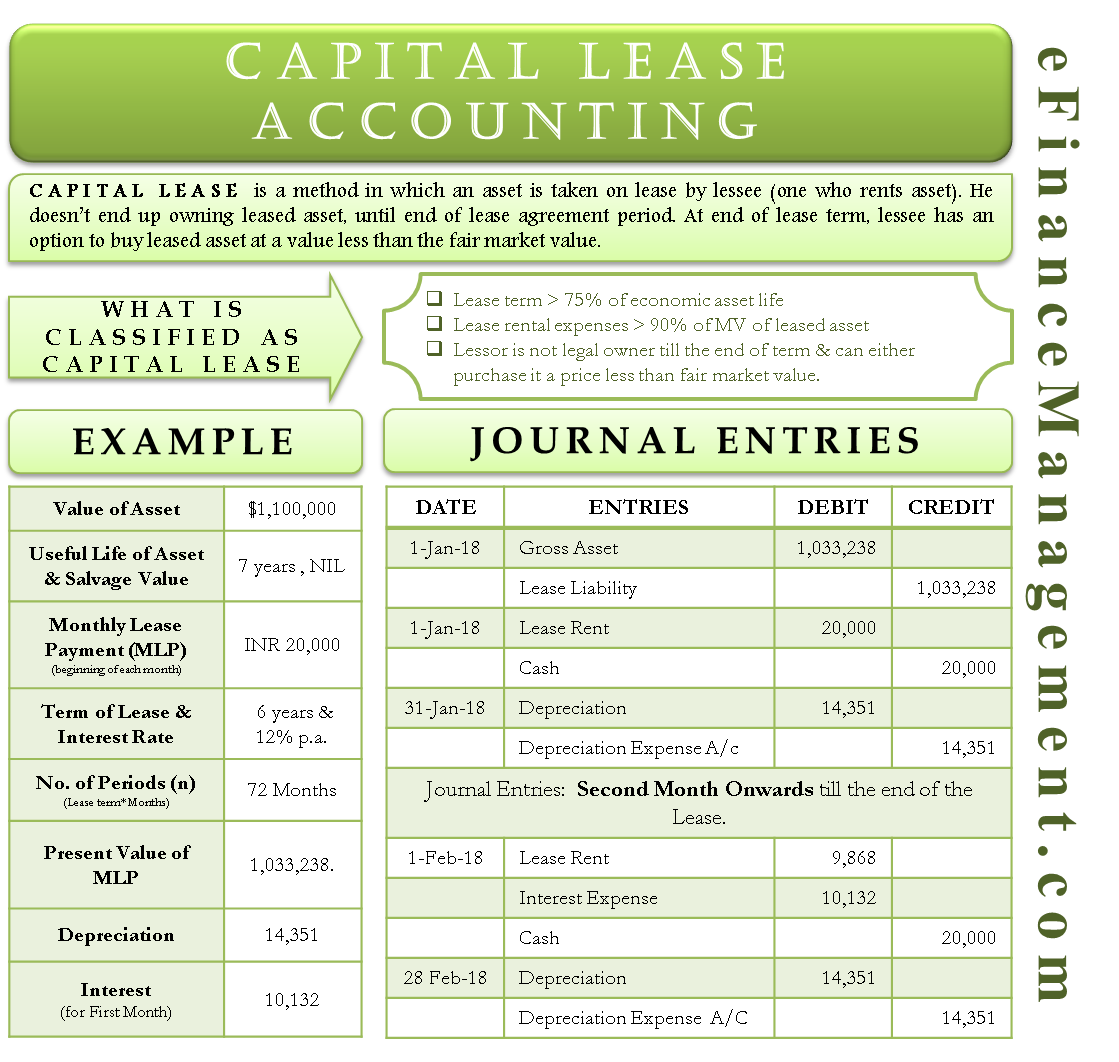

Let s assume that a company is leasing a vehicle.

Lock in a low lease payment with agdirect s special lease residuals.

Current capital equipment lease rates businesses pay.

This can make budgeting problematic depending on the size of.

Also gain some knowledge about leasing experiment with other financial calculators or explore hundreds of calculators addressing other topics such as math fitness health and many more.

Unlike a lease which provides fixed rate financing a loan or line of credit s interest rates may fluctuate throughout the loan term.

The company is financing 19 000 and will make annual payments of 6 000 for four years.

With a lease the manufacturer or the dealer of the equipment may provide the financing.

Special pro put and fpo residuals on new and used grain carts dump carts forage wagons dump wagons tillage equipment and heads cornheads drapers platforms.

Free lease calculator to find the monthly payment or effective interest rate as well as interest cost of a lease.

An example of calculating a capital lease interest rate.